new short term capital gains tax proposal

The individual tax rate could just from 37 to 396 for those making more than 400000 annually. Portugal proposes a 28 short-term capital gains tax According to a report by Bloomberg the proposal will be part of the Portugal 2023 draft budget.

Washington State Capital Gains Tax The 7 Things You Need To Know

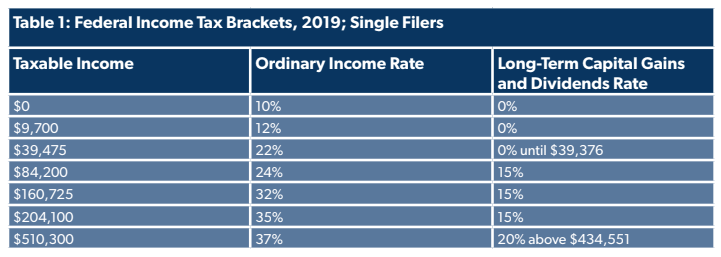

Short-term capital gains rates are the same as ordinary income tax rates.

. Inslees 21-23 capital gains tax proposal QA. Governor Inslee is proposing a capital gains tax on the sale of. Raising the top capital gains rate for households with more than 1 million.

Inslee proposed in his 2021-23 budget see Gov. Best short-term investments. For example if you sold a stock less than a year after you bought it then youll pay the short-term capital gains ratewhich is the same as your ordinary income tax rate.

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax. Capital gains on assets that are held for less than one year are known as short-term capital gains and are currently taxed at the same rate as ordinary income for individuals. WHAT BIDENS CAPITAL GAINS TAX PROPOSAL COULD MEAN FOR YOUR WALLET.

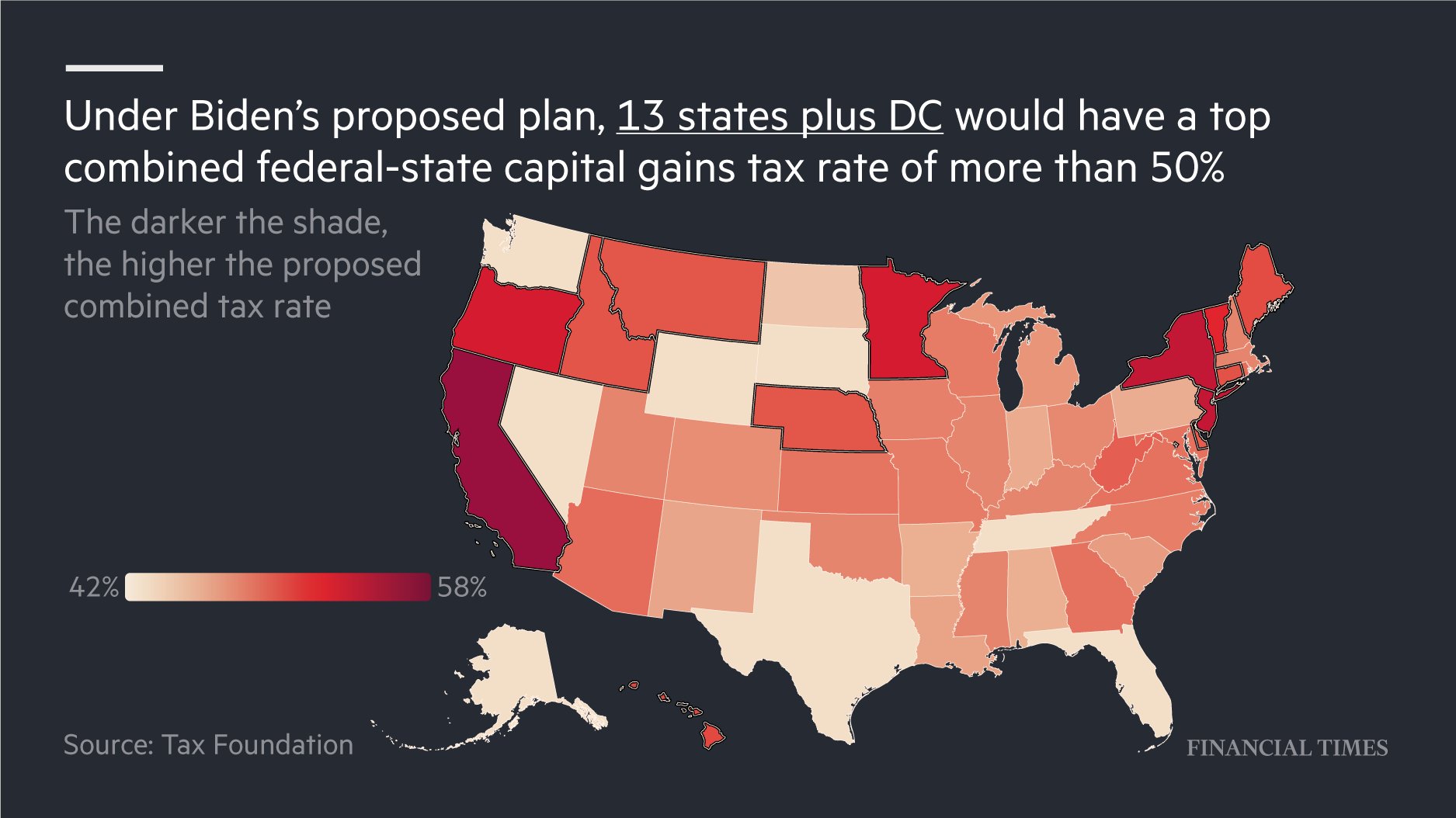

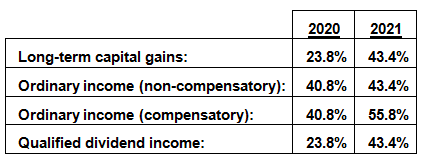

So for 2018 through 2025 the tax rates for higher-income people who recognize long-term capital gains and dividends will actually be 188 15 38 for the NIIT or 238 20 38 for. Short-term capital gains on assets sold within a year are typically taxed as ordinary. Given what the president has proposed the wealthiest people in the US could see a significant hike in the capital gains tax rate.

Just like income tax youll pay a tiered tax rate on your capital gains. Subscribe to receive email or SMStext notifications about the Capital Gains tax. It would apply to those with more than 1 million in annual income.

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to. To see what Gov. For example a single person with a total short-term capital gain of 15000 would pay 10 of 10275.

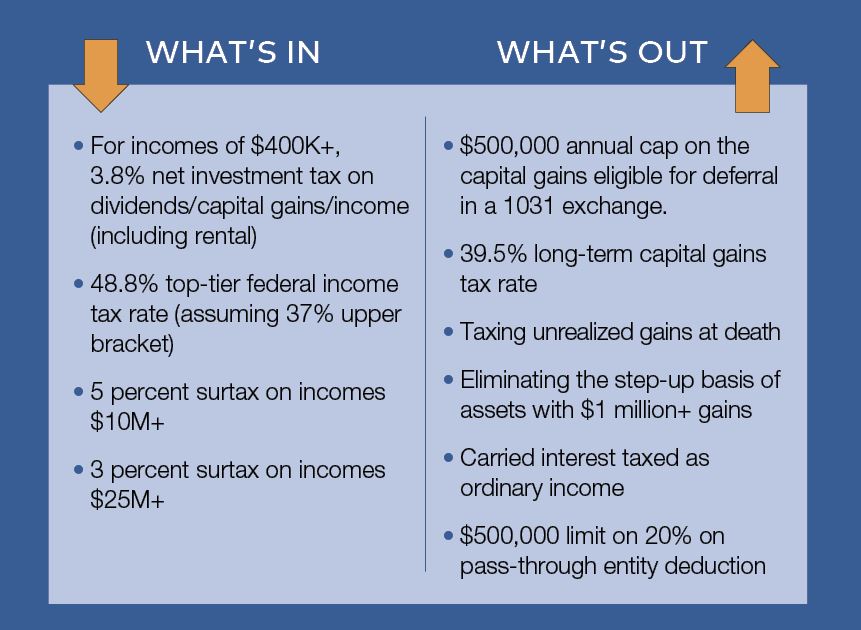

The proposed higher tax on capital gains would be consistent with President Bidens promise to limit tax increases to single filers making. New Bill Will Tax Real Estate Promote as Carried Interest Subject to Three-Year Holding Period. Under Bidens proposal the rate theyd pay on investment profits would nearly double from 20 to 396.

This rate hike will affect stocks bonds cryptocurrencies and. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. Senators Manchin and Schumer this week announced.

Subscribe to receive email or SMStext notifications about the Capital Gains tax. New short term capital gains tax proposal Friday March 18 2022 Edit. Friday July 29 2022.

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

What Would The New Carried Interest Loophole Proposal Do The New York Times

Mechanics Of The 0 Long Term Capital Gains Rate

What S In Biden S Capital Gains Tax Plan Smartasset

What Will Be In The Biden Tax Plan Riddle Butts Llp

Capital Gains Taxes Are Going Up Tax Policy Center

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Financial Times On Twitter Raising Top Income Tax Rates Is Not Sufficient To Raise Revenue The Rich Often Make Money Through Capital Gains Which Are Taxed At A Lower Rate Biden Is

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Real Estate Capital Gains Tax Rates In 2021 2022

Capital Gain Tax Rates Could Nearly Double Under Biden Proposal Here S Who It Would Affect And How

Opinion Biden Proposes A Big Change To Capital Gains Taxes This Is How They Work And Are Calculated Marketwatch

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union

Tax Issues And Planning To Consider Before Year End 2020 Kleinberg Kaplan

Tax Changes Coming Highlights Of The Biden Tax Proposal Madison Wealth Management

Three Tax Management Charts Every Advisor Should Study 2018 Russell Investments